Impressive Deferred Tax Asset Calculation Example

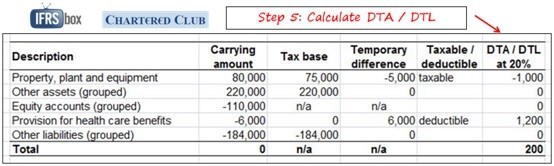

Cover some of the more complex areas of preparation of a deferred tax computation for example the calculation of deferred tax balances arising from business combinations.

Deferred tax asset calculation example. And the lease liability under IFRS 16 are CU 435. Worked example accounting for deferred tax assets. If a business incurs a loss in a financial year it usually is entitled to use that loss in order to lower its taxable.

Example Consider an Electronics Company XYZ Inc which gives a warranty on the goods and assumes that the warranty repairs cost will go around 5 of the total revenue. DEFERRED TAXATION ACCOUNTING A SIMPLE EXAMPLE Assume. Illustration of the purpose of deferred tax liabilities In 20X1 Entity A purchases a fixed asset that costs 1000.

In the above example assume AZN shares have a cost base of 600 and at the balance sheet date are valued at 1800 since the shares have been revalued up by 1200 suppose the asset is to be sold at this revalued price taking into consideration of 13 CGT discount there will be 120 tax payable. The sections of the guide are as follows. Tax deferred liability 280015 420.

Which recognizes both the current tax and the future tax Deferred Tax consequences of the future recovery or settlement of the carrying amount of an entitys assets and liabilities. Hence the tax base of the inventory is not reduced by the write off. The write off of inventory will generate tax relief but only in the future when the goods are sold.

IAS 12 Income Taxes Overview. It is the excess amount of cash paid to the government in the name of tax. DTD expected to reverse.

Ts tax rate is 50. Example Calculation and impact of deferred tax liability and asset In the first year we have deferred our tax liability of Rs 3708 by charging higher depreciation in IT act compare to companies act. The benefit of deferred tax assets is that the Company will have less tax outgo in the future subsequent years.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)