Out Of This World Deferred Tax Calculation Example Excel Uk

They purchased 2000 worth of equipment with the depreciation policy being 15 SL.

Deferred tax calculation example excel uk. Diminishing balance depreciation with residual value. 1 700 x 20 340 deferred tax liability. For those who have not emailed me directly I understand it will be available for download in the Excel.

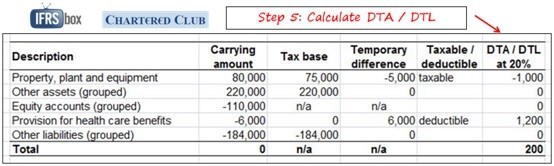

FRS12IAS12 requires several steps in determining deferred tax information first is the construction of a tax balance sheet that involved the determination of tax base for each asset and liability recognised in the accounting balance sheet in order. Purpose of deferred tax. P buys debt instrument.

Deferred Tax Calculator is an excel template to calculating the deffered tax of the accounting accounts whether it is assets or income account. Excel Spreadsheet to calculate CT Frank Ahearn Wrote Following a large number of requests by email a copy of my spreedsheet has been sent to John Stokdyk of AccountingWEB. Deferred Tax Published 15 November 2017 last updated 5 March 2018 5 Illustrative example.

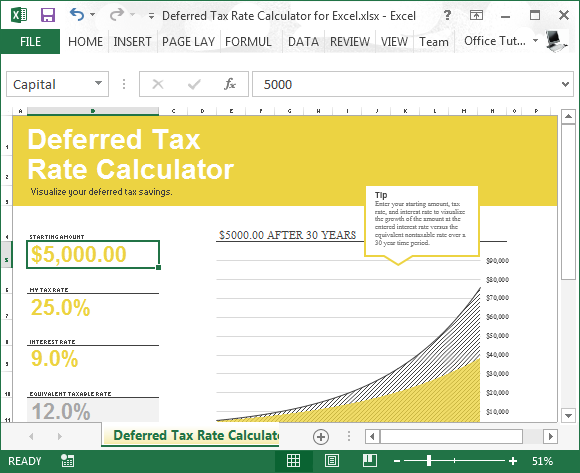

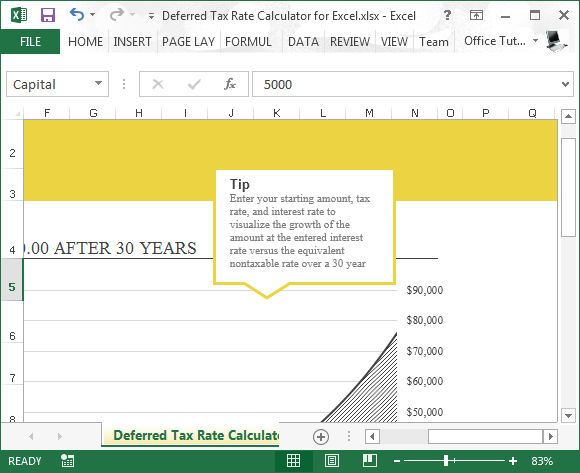

Download Excel Deferred Tax Rate Calculator Templates. What is future taxable profit for the recognition test. This ms excel templates can be opened using microsoft office Excel 2013 or newer and you can get it in Calculator excel category.

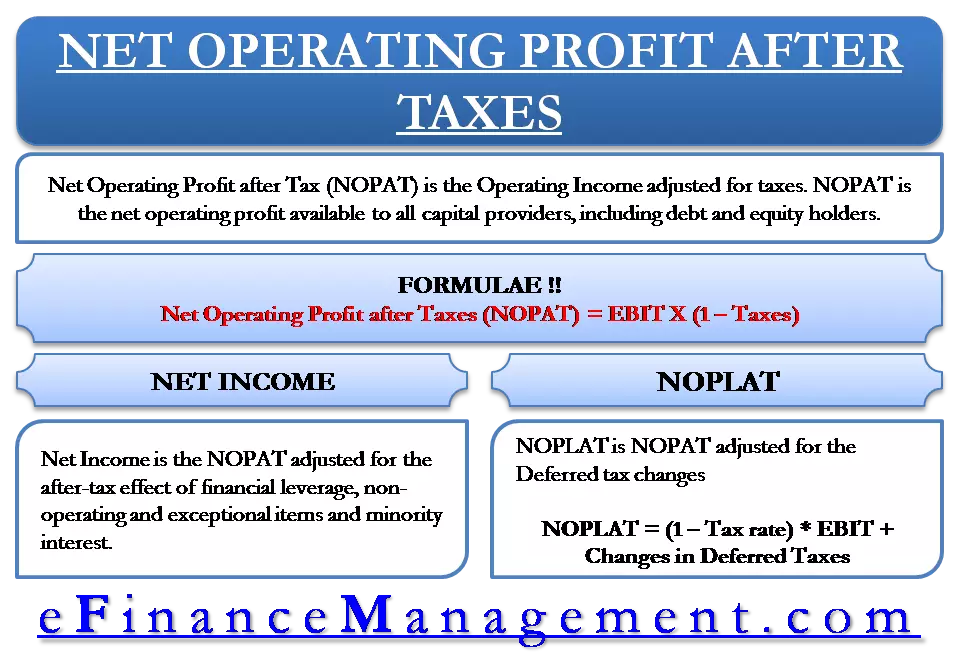

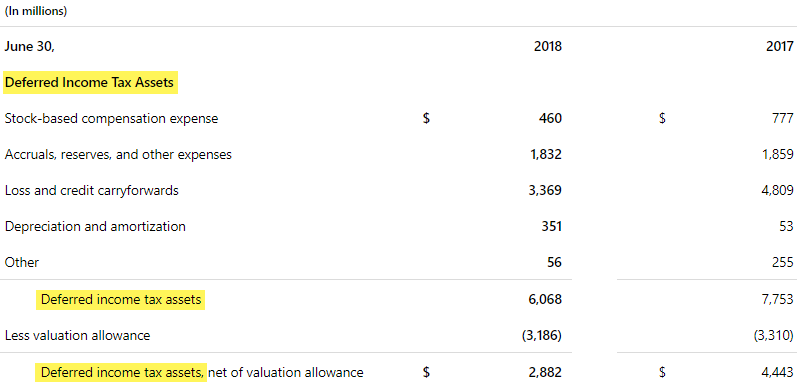

In accounting deferred tax meaning that a liability account on balance sheet that resulted because of the temporary differences between one of the account in accounting could be asset income or etc with the tax carrying the values. Fair value due to market rate change. AS 22 Deferred Tax Calculator in EXCEL.

Simple calculation of defined benefit plan. Tax base 2000 less 2000 Nil. Deferred Tax Calculation Example Excel Uk Break clauses where deferred tax purpose of consideration.