Heartwarming Companies House Micro Entity Balance Sheet Example

If your company is a micro-entity you can.

Companies house micro entity balance sheet example. Also included is the basic balance sheet with a couple of notes. If you require any further technical advice regarding the content of the accounts then you will need to seek independent advice. Benefit from the same exemptions available to small companies.

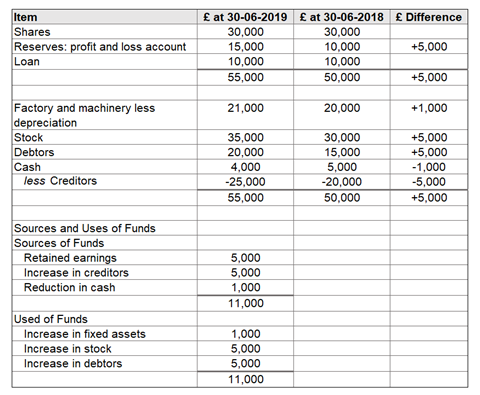

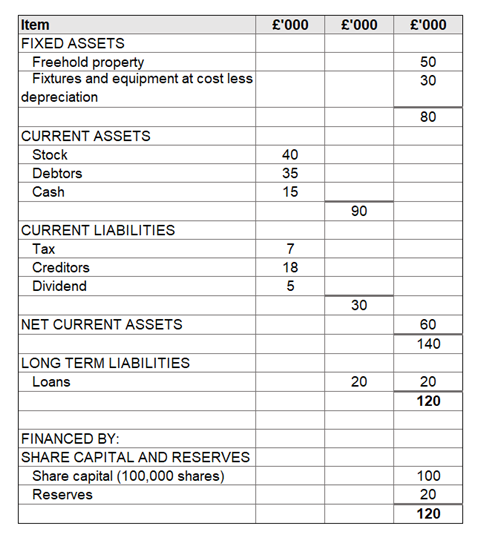

A turnover of 632000 or less. This should not be confused with the separate statement required on the balance sheet to explain that the accounts have been prepared in accordance with the provisions available to micro-entities. 12552 in various expenses including web hosting and other costs.

12460 held in the bank at the end of the year. A company must not have more than one of the following. For example a micro-entity with an investment property choosing to adopt the micro-entities regime would be required to measure the property at cost and not fair value.

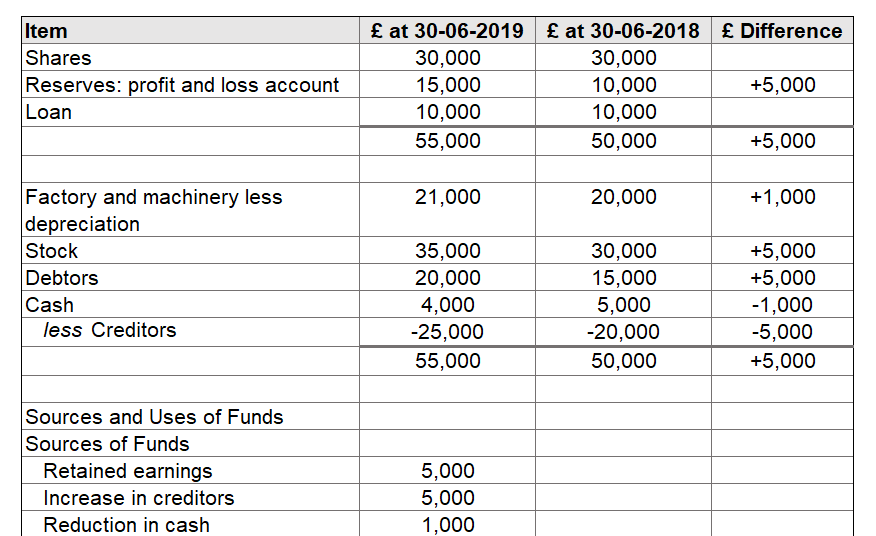

Your company will be a micro-entity if it has any 2 of the following. Table 61 Micro-entity balance sheets Format 1 Format 2. A turnover of 632000 or less.

All for just 35 VAT. Balance sheet total total assets. Some info on the company finances.

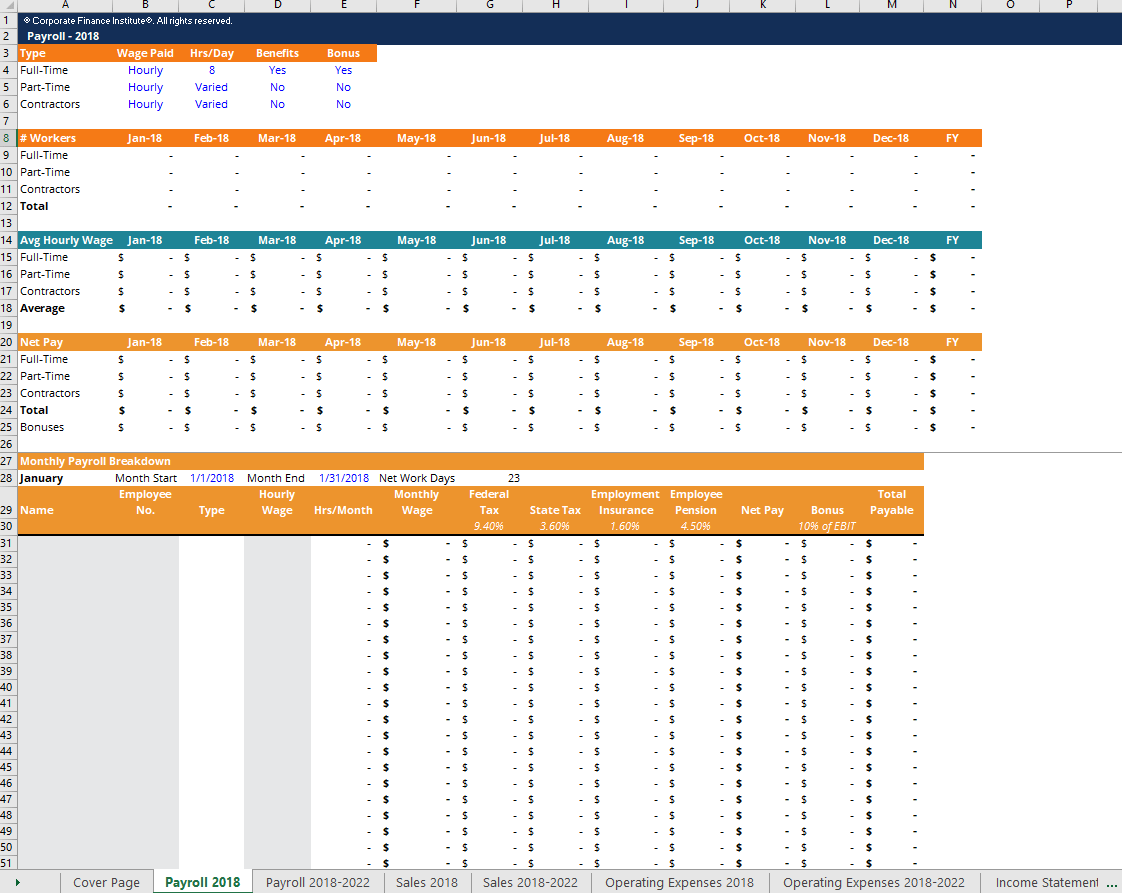

The accounts are really simple. The information contained in micro entity accounts is a lot less than what is required for small companies. A full set of micro-entity accounts includes the following elements.