Marvelous Typical Balance Sheet Items

Assets Liabilities Owners Equity.

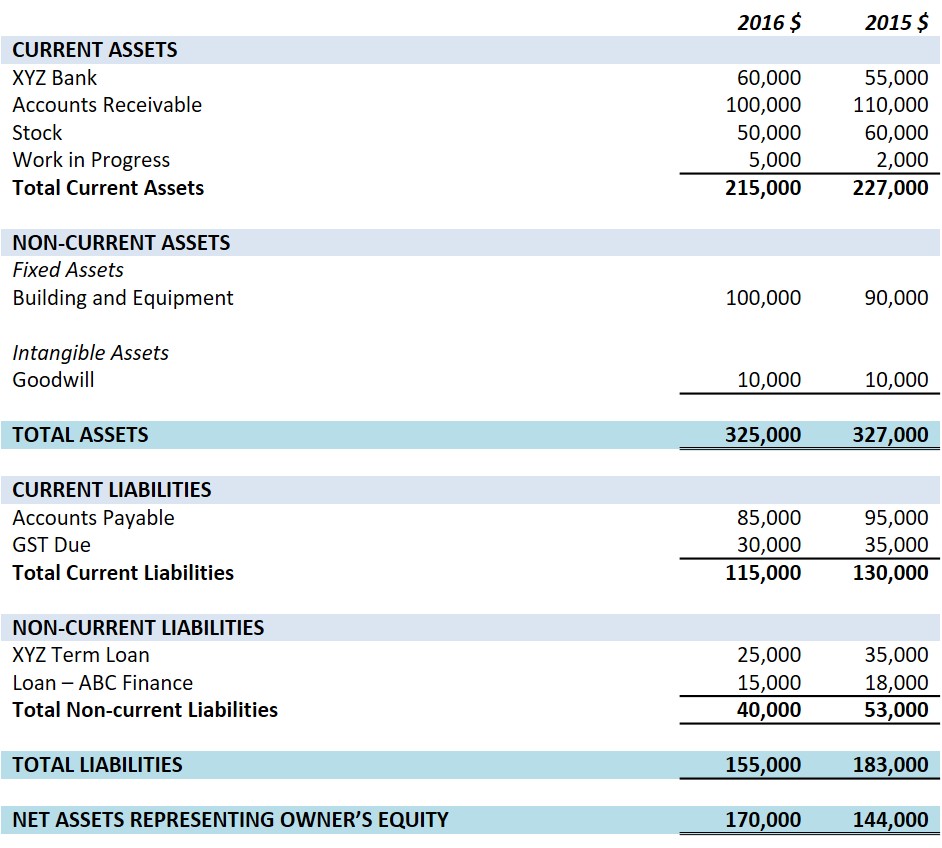

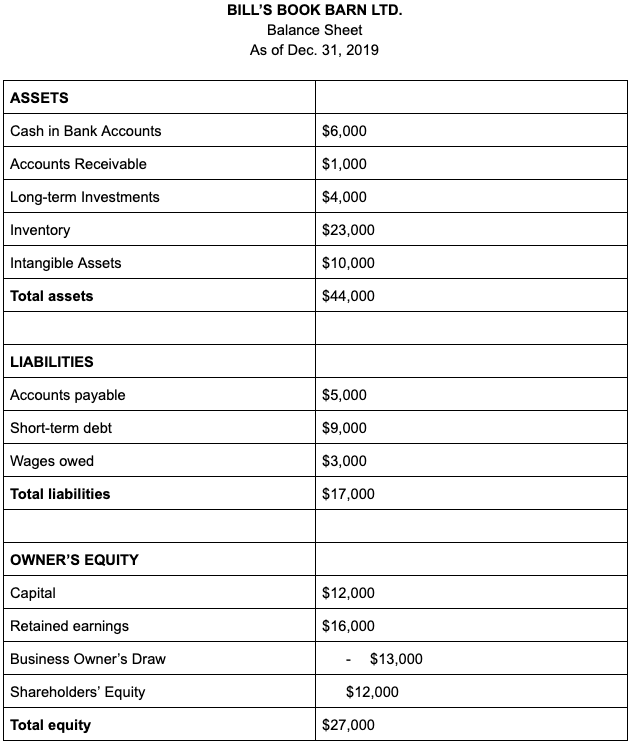

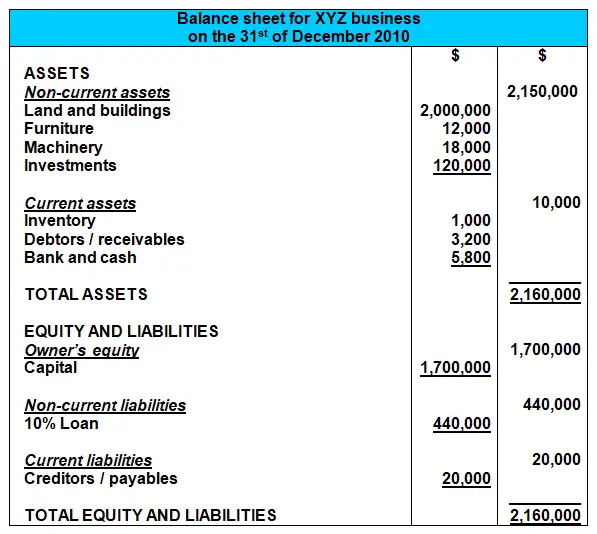

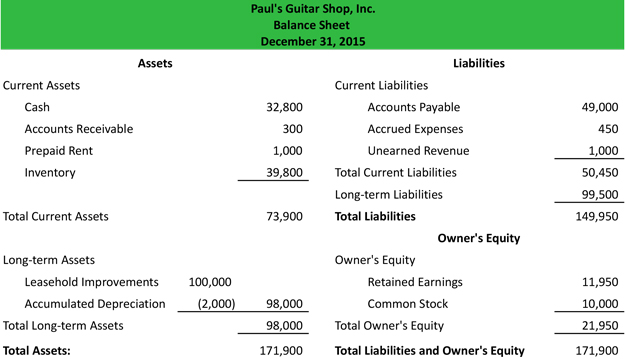

Typical balance sheet items. Format of the balance sheet There are two formats of presenting assets liabilities and owners equity in the balance sheet account format and report format. The principal payments of a mortgage loan or an equipment loan that must be paid within one year of the date of the balance sheet are reported in this item. It is called the Balance Sheet because it reports on Asset Liability and Equity accounts and is meant to show that these three accounts balance according to the accounting equation.

Accounts payable accrued liabilities customer prepayments taxes. Also the balance sheet is often abbreviated as BS or BS. Assets on one side and liabilities and equity on the other side.

This horizontal format basically looked like one giant T-account for the whole business with Assets on one side and Liabilities and Owners Equity on the other. The equation reflects how information is organized on the balance sheet with assets listed on the left and liabilities and equity on the right. The typical structure of a balance sheet for a bank is.

The notes to the financial statements are omitted as they will be identical regardless of the format used. To be reported as a current liability the item must be due within one year of the balance sheet date unless the companys operating cycle is longer. For each of the following balance sheet items use the letters above to indicate the appropriate classification category.

The business purchases a new computer for 40000 from the bank account. In the account form shown above its presentation mirrors the accounting equation. We will present examples of three balance sheet formats containing the same hypothetical amounts.

The current portion of long-term debt. Cash marketable securities prepaid expenses accounts receivable inventory and fixed assets Liabilities. Here is the balance sheet equation.