Impressive Off Balance Sheet Risk Example

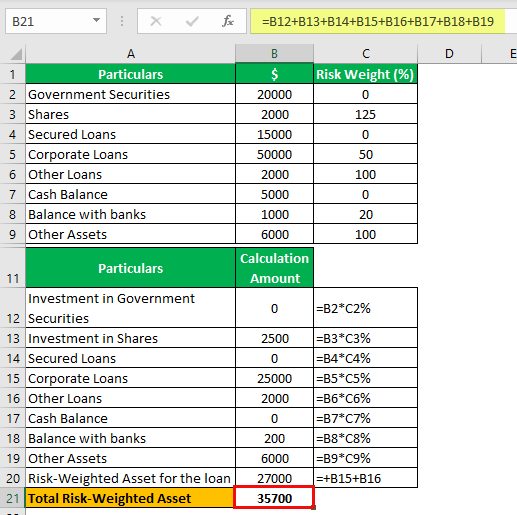

Four measures of risks to bank balance sheets Our analysis focuses on four important ratios that capture different balance-sheet risks12 A leverage ratio measures risk associated with non-capital funding of overall balance sheets.

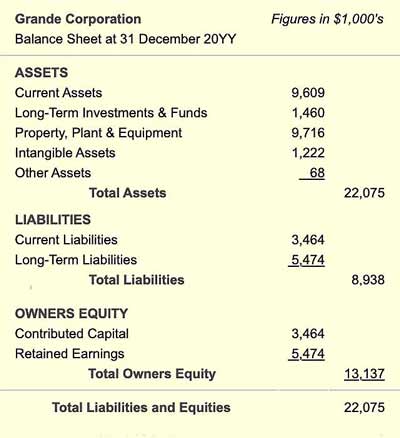

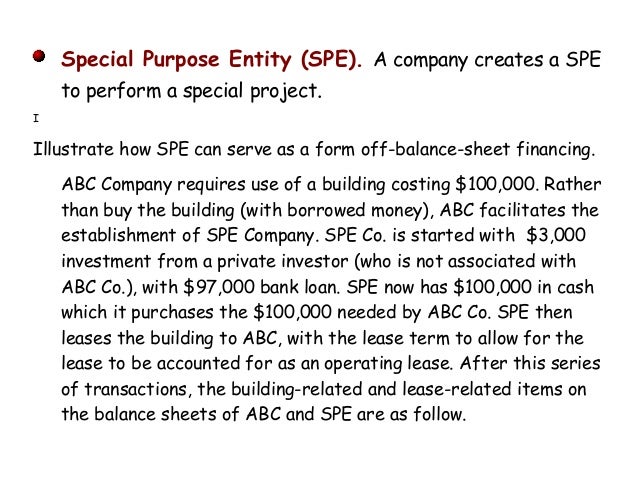

Off balance sheet risk example. Securitisation special purpose vehicles. It is defined as. Off-balance sheet items are typically those not owned by or are a direct obligation of the company.

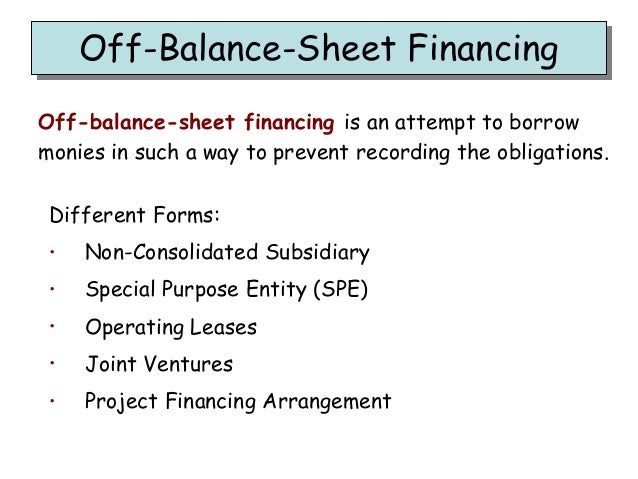

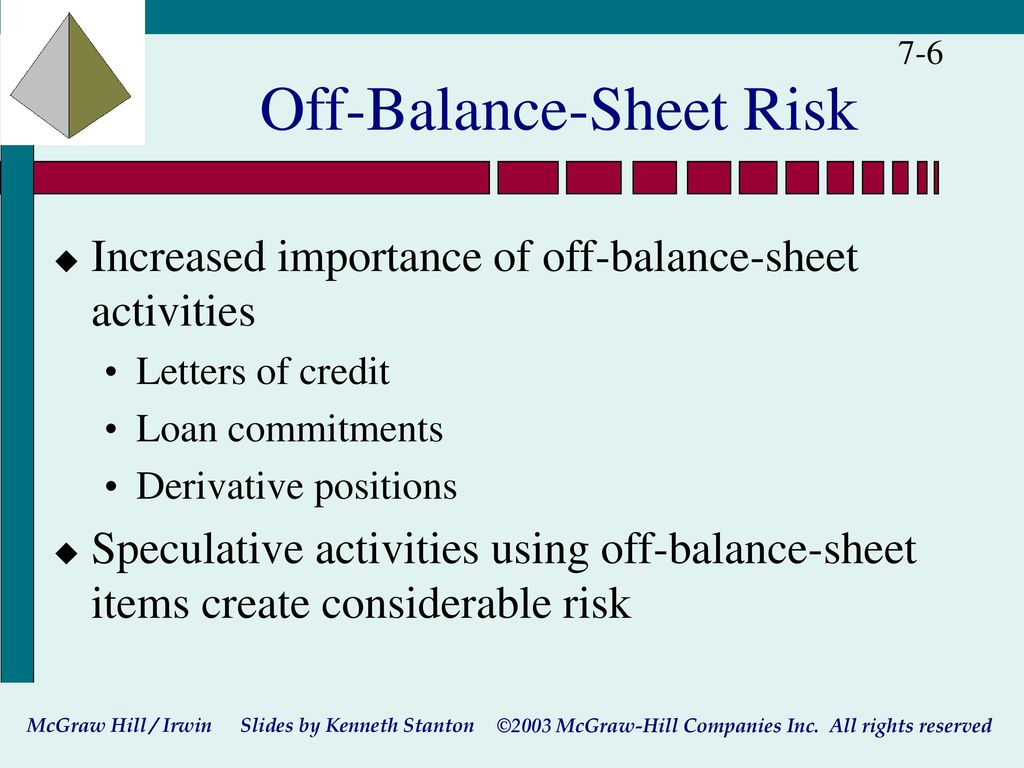

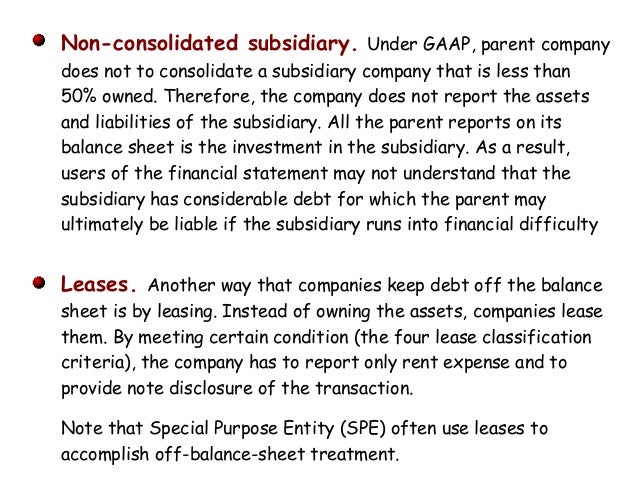

Off-balance sheet contracts eg. Off-balance sheet Risk the risk posed by factors not appearing on an insurers or reinsurers balance sheet. For example when loans are securitized and sold off as investments the secured debt is often.

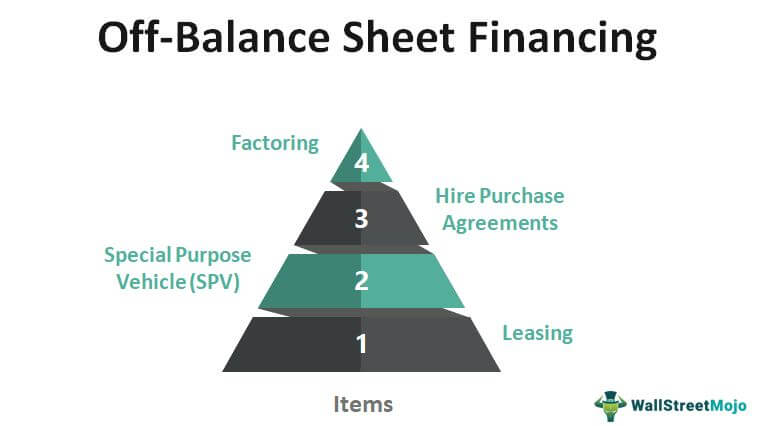

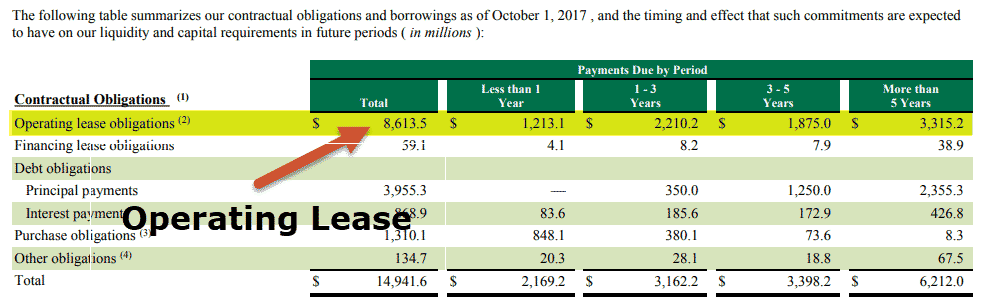

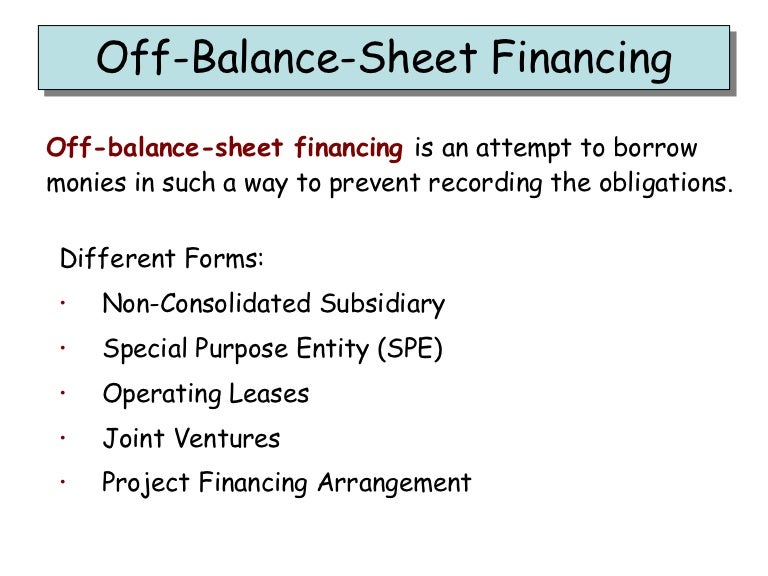

For example if a company uses an operating Jease capital is not tied up in buying the equipment since the only rental expense is paid out. Beta Alpha Psi 1993 first place undergraduate manuscript. Off-Balance Sheet Exposures Since the 1980s off-balance sheet commitments have grown rapidly in major banks among which there are swaps forward rate agreements bankers acceptances revolving underwriting facilities etc.

The use of off-balance sheet may improve activities earnings ratios because earnings generated from the. Liquidity and funding risk in banks. Excessive imprudent growth and legal precedents affecting defense cost coverage are examples of off-balance-sheet risk Definition 3.

The asset is not shown on the companys balance sheet. So now the company only has to show the rental payments or any other payments associated with the assets on its financial statements. Therefore the overall impact of off-balance sheet activities on the riskiness of banking institutions is an.

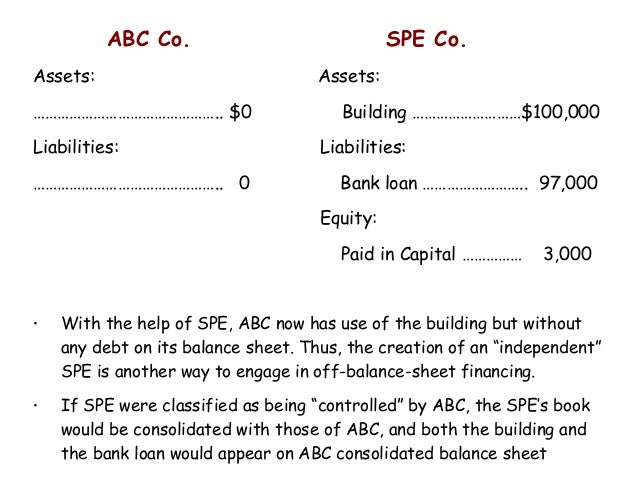

Institutionsare required to report off-balance sheet items in conformance with Call Report Instructions. As the amount at risk is not always equal to the nominal principal amount of the contract off-balance sheet credit exposures are first converted to a credit equivalent amount. It is computed as the current replacement cost if positive plus an add-on factor.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)