Peerless Gaap Accounting For Pass Through Expenses

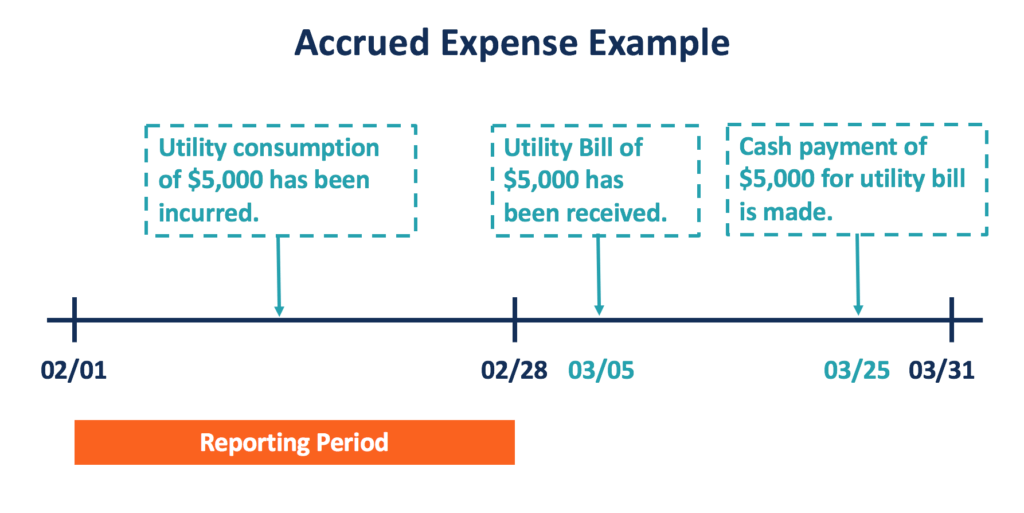

Pass-through grants are those grants that are received by a recipient government to transfer to or spend on behalf of a secondary recipient.

Gaap accounting for pass through expenses. Im warning others as strongly as I possibly can based on my expertise and experience to not heed your advice when it comes to applying US GAAP accounting principles which by the way ARE rules. A second level of income taxes are incurred at the C corporation owner level when after-tax net income is distributed in the form of dividends. Pass through arrangements.

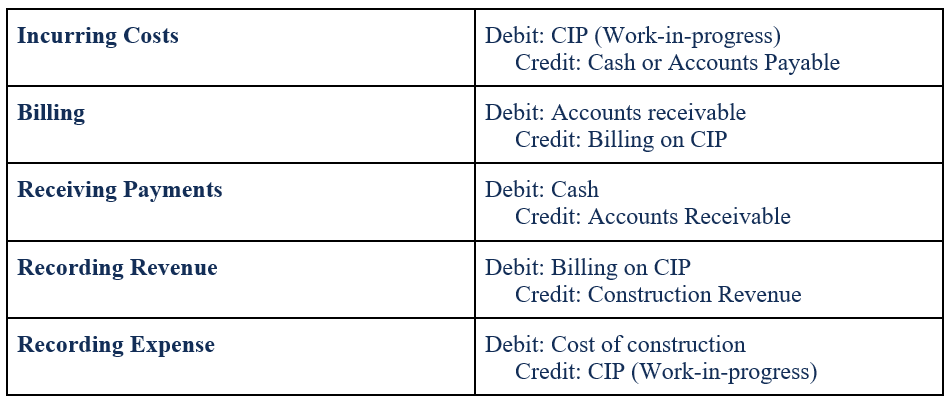

The source guidance is EITF Issue No. We never net billings against expenses and show as a net zero expense in GA expense. 252 An entity shall not offset assets and liabilities or income and expenses unless required or permitted by an FRS.

01-14 Income Statement Characterization of. This is a straight in and out pass through however there are months of time lag between the two. A Measuring assets net of valuation allowances for example allowances for inventory obsolescence and allowances for uncollectible receivables is not offsetting.

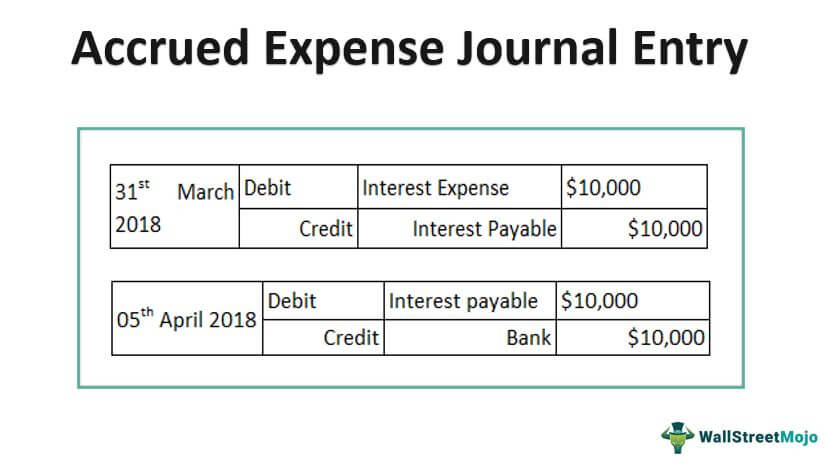

Validate or refuse with just one click. Basically When expense is incurred. If you ever might have non-ductible expense of your own you may wish to set up an expense account called Non-Deductible Expenses Any actual expenses will show on your PL but your tax CPA will know to remove them prior to tax filing in fact if you map accounts to tax forms this account would not be mapped.

The IRS allows full deduction of customer-reimbursed Meals and Entertainment assuming theyre reasonable and customary business expenses since these pass-through and net to zero. Counting Principles GAAP and International Financial Reporting Standards IFRS there are clear standards that every business owner accountant and asset manager and or property owner must follow for properly identifyingrecog-nizing and then recording their fixed assets aka. Ad Managing your expenses has never been easier.

Pass through costs conceptually are those which are incurred by an enterprise incidental to the business activity and in respect of which the enterprise does not perform any significant function or. With Odoo Expenses youll always have a clear overview of your teams expenses. You are jumbling things up a lot unnecessarily especially if you are just going to net things at the end anyway.

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)