Best Examples Of Off Balance Sheet Items For Banks

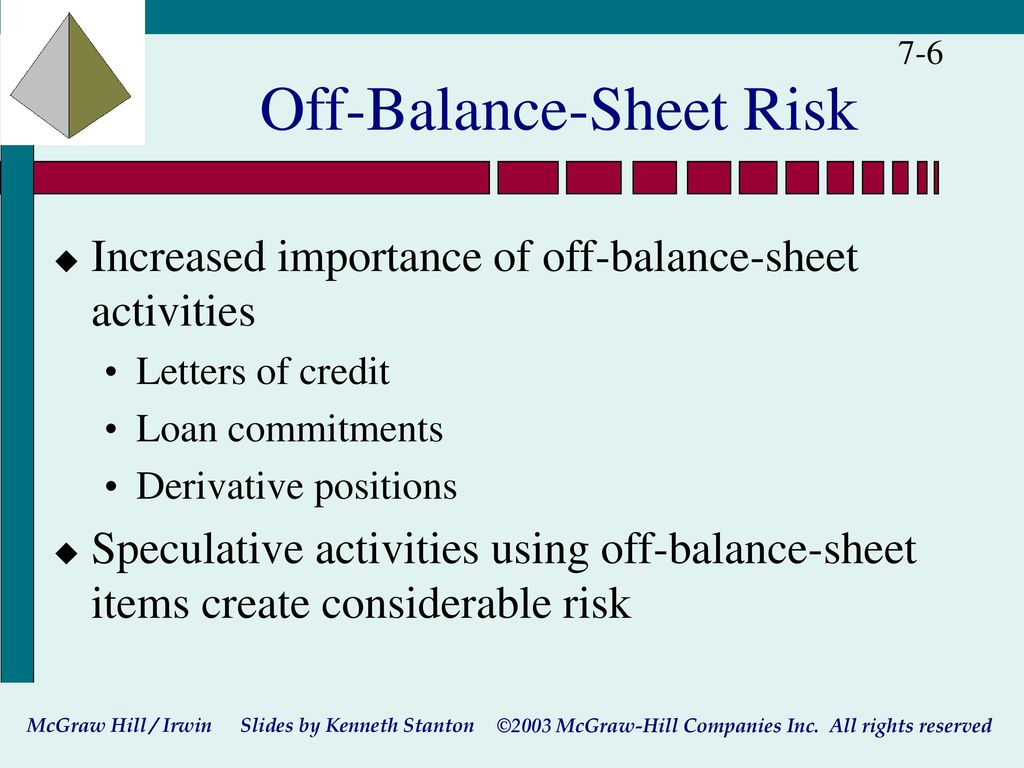

Off-balance sheet activities include items such as loan commitments letters of credit and revolving underwriting facilities.

Examples of off balance sheet items for banks. Journal of Accounting Auditing Finance. Financial institutions such as banks brokerage firms insurance companies and so on usually report off-balance sheet items in footnotes to their balance sheets or may include such items in assets under management category comprising both on and off. Assume that a company has an established line of credit with a bank whose.

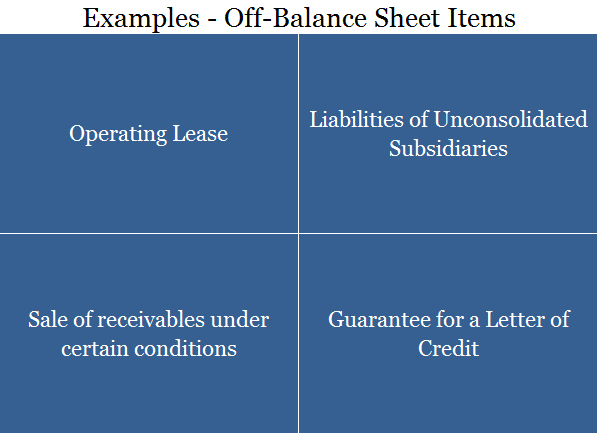

Selected items from the liabilities deposits. Other examples of off-balance sheet items include guarantees or letters of credit joint ventures or research and development activities. Which are contingent in nature are some of the examples off -balance sheet.

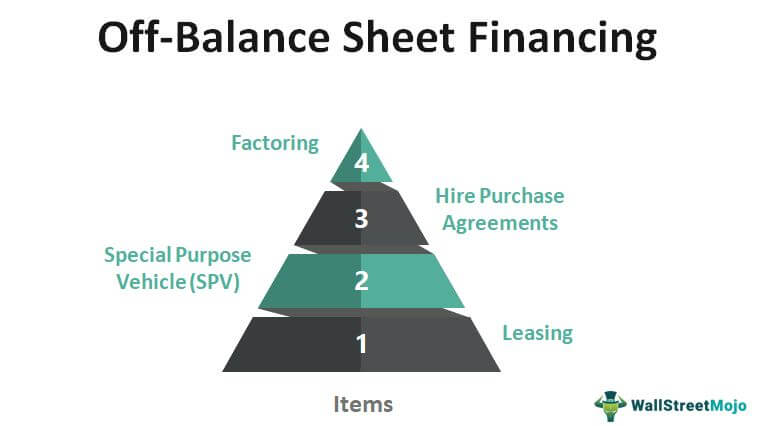

Many such activities for example swaps options and. In this case the assets being managed by firms do not belong to them but to the clients so they are not recorded on the balance sheet. The non-fund based facilities like Issuance of letter of guarantee letter of credit deferred payment guarantee letter of comfort.

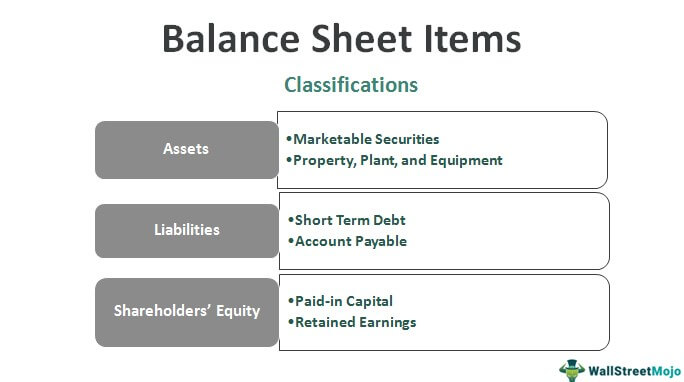

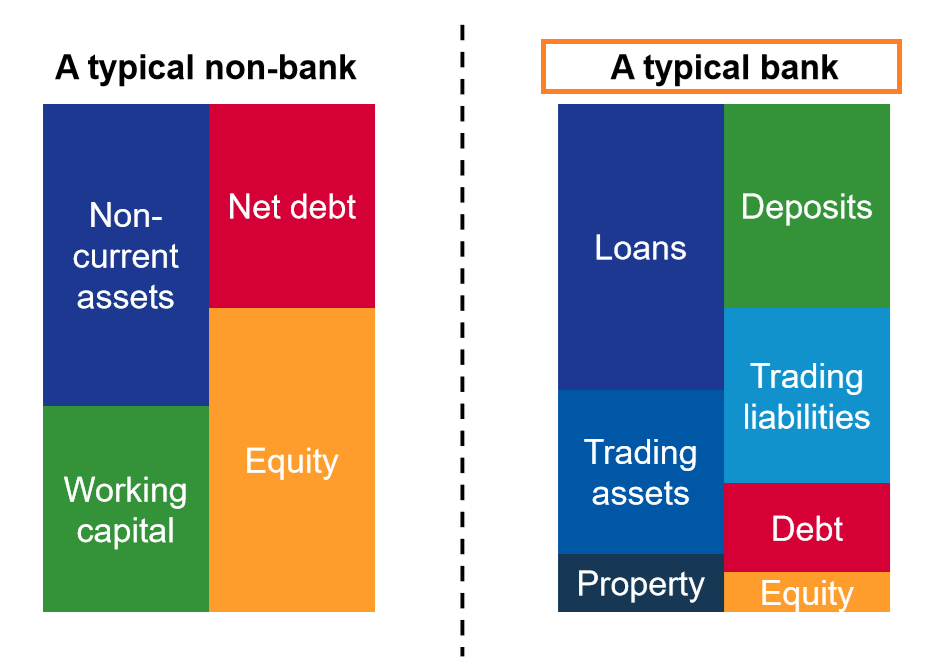

Investments of clients held by an investment company etc. Banks conduct a wide variety of activities off the balance sheet which have an impact on their interest rate exposure. The information included in a credit institutions balance sheet makes it possible to analyze its investment and financing structure in both absolute values and percentages.

OffBalance Sheet Activities and the Underinvestment Problem in Banking. These products are mostly off-balance sheet instruments such as interest rate swaps futures and forward contracts options and securitization. The loans a bank has made are weighted in a broad brush manner according to their degree of riskiness eg.

Institutionsare required to report off-balance sheet items in conformance with Call Report Instructions. 4 Issue 2 p111-124. Off-balance sheet contracts such as guarantees and foreign exchange contracts also carry.

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)