Smart Determine The Missing Amounts In The Following Accounting Equations

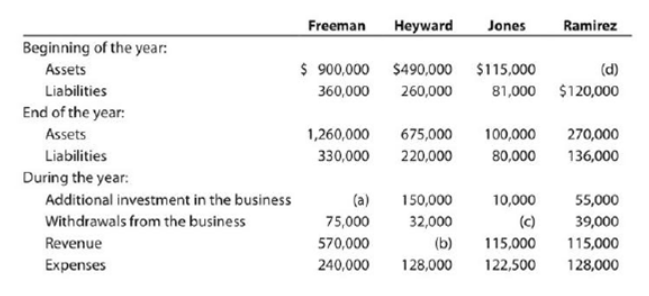

Since the statement is mathematically correct we are confident that the net income was 64000.

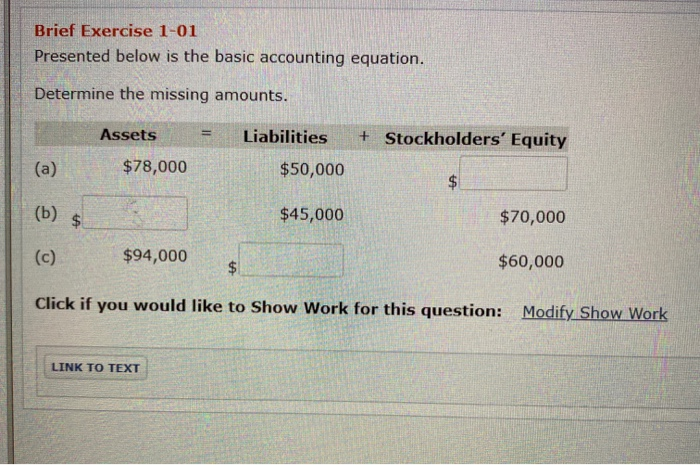

Determine the missing amounts in the following accounting equations. Determine the missing amounts in the following accounting equations S24000 6300028000 45000 106000 94000 5 5-10 min. Thats all there is to the fundamental accounting equation. Accounting QA Library Determine the missing amount for each of the following.

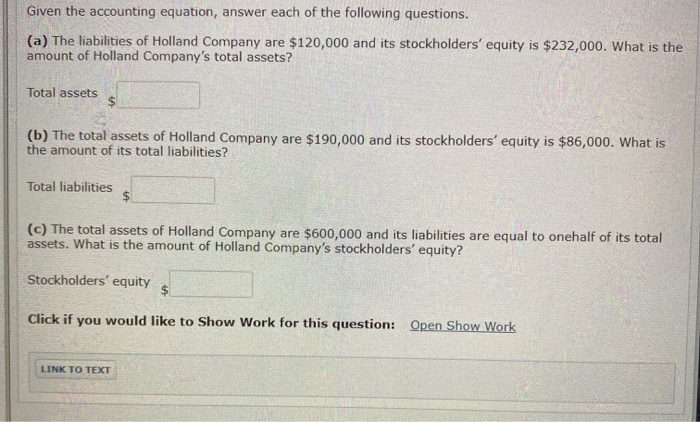

Assets Liabilities Stockholders Equity a. Review the highlighted accounts to determine if they qualify as assets liabilities or equity accounts. Accounting Equation Determine the missing amount for each of the following.

You can use the same equation to solve countless accounting problems. Insert the previously missing amount in this case it is the 64000 of net income into the statement of changes in owners equity and recheck the math. Compare these accounts to those on the current balance sheet.

Negative amounts should be indicated with minus signs and unaffected should be noted as 0. Assets Liabilities Shareholders Equity Revenue Expenses Draws. Complete the chart to determine the ending balances.

After purchasing the baseball bat your assets lie at 995 liabilities at 245 and equity at 750. A financial claim is a legal right to an item. 92000 Enter any number in the edit fields and then continue to the next question Type here to search.

For Teachers for Schools for Working Scholars. Case A Case B Case C 240000 7500 15000 Sales Beginning inventory raw material Ending inventory raw material Purchases of raw material Direct material used Direct labor Manufacturing overhead Total manufacturing costs Beginning inventory work in process Ending inventory work in process Cost of. Assets Liabilities Equity or Capital.