Divine Consolidated Balance Sheet Example Solution

Consolidated Balance Sheet Excel template with examples.

Consolidated balance sheet example solution. P Ltd acquired Q Ltd on 112018. Say you have 450000 in total assets between your parent company and your subsidiary. Their balance sheet as at 3132017 is given below.

Mommys investment in Babys shares is 0 as we eliminated it in the step 2. Prepare balance sheet for F. The fair value of net assets of the Company B at the time of acquisition was 40 million.

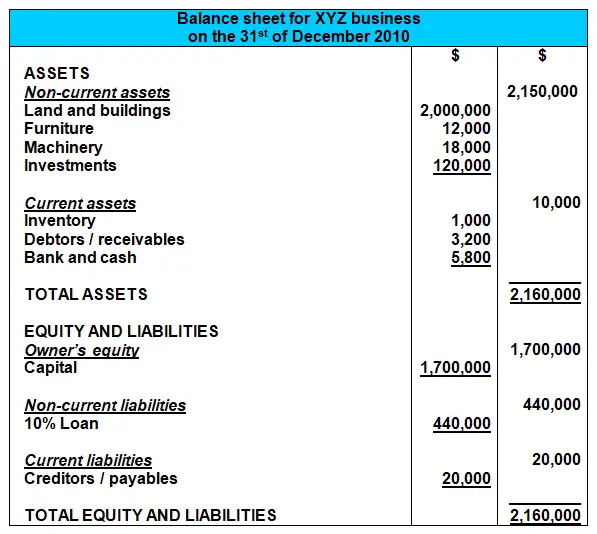

The following trial balance is prepared after preparation of income statement for F. Immediately prior to the purchase the equity sections of the two firms appeared as follows. Format and example of consolidated balance sheet.

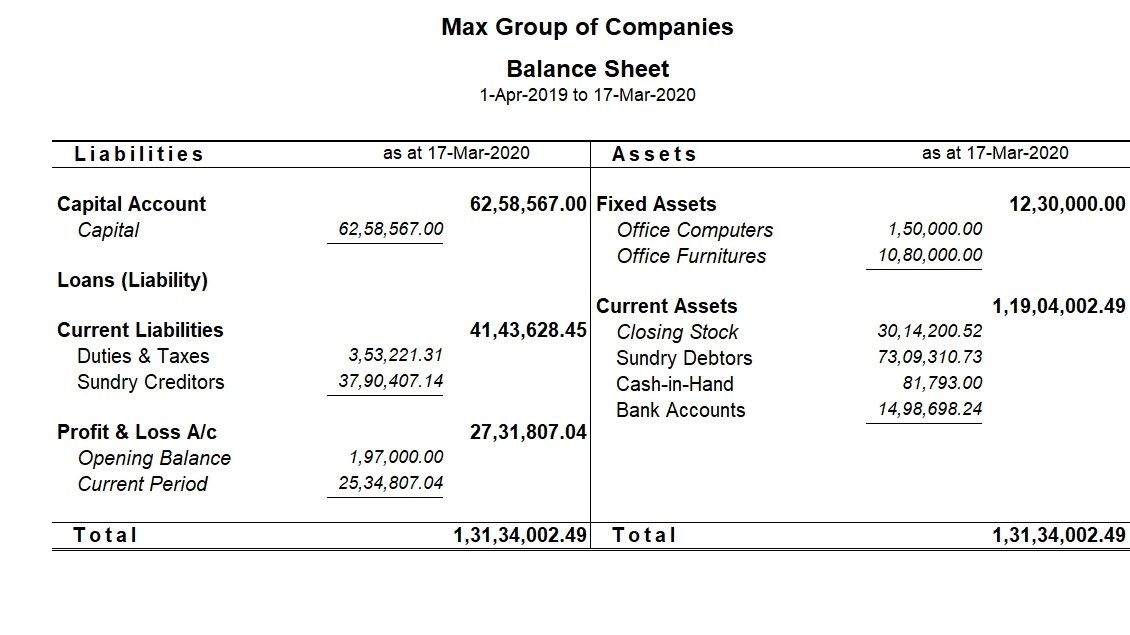

Pre acquisition profit and reserve of subsidiary company will be shown as capital reserve in consolidated balance sheet but the value of minority interests profit or reserves deducts from it and add in minority interest value. They consist of a balance sheet income statement and cash flow statement providing a 260-degree view of the health of a parent organization and its subsidiaries. As these are separate entries Mr Max would like to prepare the consolidated financial statements and evaluate the financial position of the group.

Consolidated numbers are simply sum of Mommys balance Babys balance and all adjustments or entries Steps 1-3. Max Hardware and Max Electronics are owned by Mr Max. Using this let us prepare a consolidated balance sheet.

Obtain in a simplified way the total values of assets and liabilities detailed also in current non-current permanent etc in addition. On July 1 2014 was equal to the fair value. Solution E3-4 in thousands 1 Implied fair value of San 1800 90 2000 Less.