Divine Company Balance Sheet Explained

It provides a snapshot of a business at a point in time.

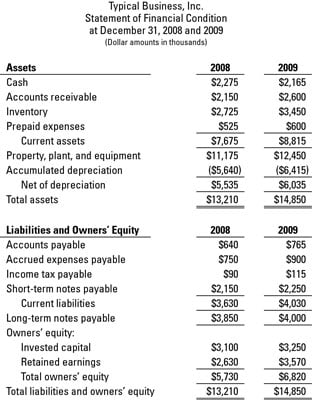

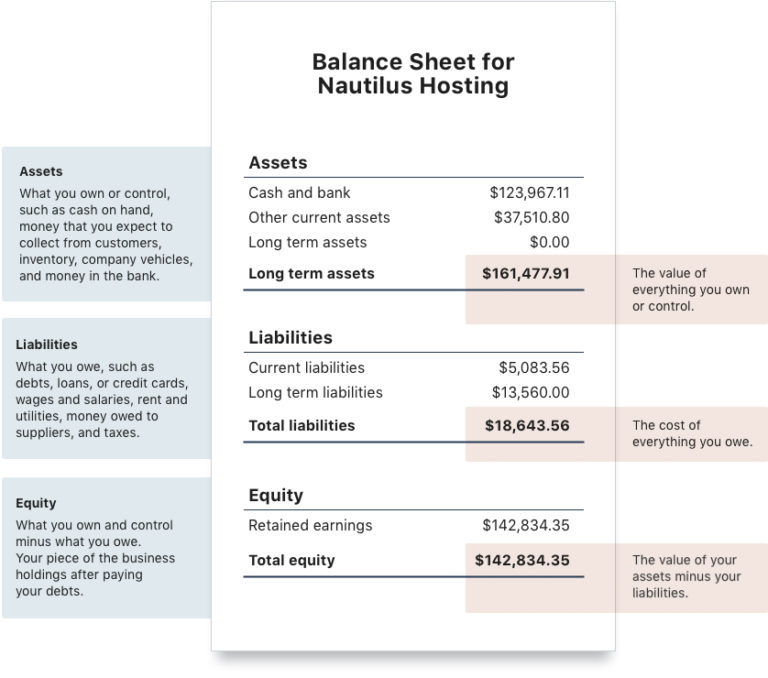

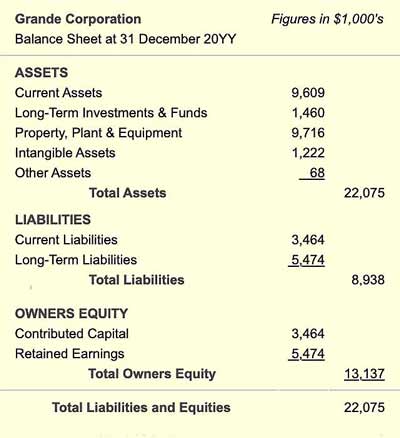

Company balance sheet explained. A balance sheet is also called a statement of financial position. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement. Assets liabilities and shareholder equity.

The profit and loss shows what has happened over a certain period of time whilst the balance sheet is a snapshot of the financial standing of a business at a particular point in time. What is a balance sheet and how can I read a balance sheet to learn more about the financial situation of a company. A balance sheet gives a snapshot of your financials at a particular moment incorporating every journal entry since your company launched.

Someone else liabilities or the business owner owners equity. It allows you to see a snapshot of your business on a given date normally month or year-end. It tells you how much you owe others and how much others owe you.

The balance sheet is based on the fundamental equation. Its the balance sheet that summarises the companys assets liabilities and. What is Balance Sheet.

The balance sheet lets you know exactly what things of value a company controls assets and who owns those assets. Balance sheets help current and potential investors better understand where their funding will go and what they can expect to receive in the future. A balance sheet lists the value of all of a companys assets liabilities and shareholders or owners equity.

A balance sheet is a great way to reveal financial standing of a company. The balance sheet gives you a snapshot of how much your business owns its assets and how much it owes its liabilities as at a given point in time. The format is based upon the accounting equation.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)